| < Previous page | Next page > |

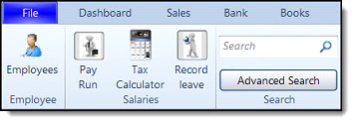

Payroll

The Payroll tab is used to manage payroll. Use the functions on the Payroll tab to manage pay runs and payslips for the company. Use the tab to create, print and email payslips for employees. Use the Payroll tab to record payments made to and on behalf of employees. The table below lists the commands available on the Payroll tab and the associated descriptions. Commands are listed by group, from left to right.

Payroll Management

The Payroll Management screen enables you to manage pay-cycles for your employees, and to define related pay slips for each pay-cycle. A pay-cycle will be auto generated by the system when the current date is after the last pay cycle end.

The type of pay-cycle created (weekly, fortnightly or monthly) will be dependent on the kind of pay-cycle your employees are defined as. When there are only weekly paid employees in the system, the system will only create weekly pay-cycles. The same is true for fortnightly and monthly employees. If there are only employees of one type in your system, only pay-cycles of that type will be created. You can also manually create pay-cycles using the plus button.

When a pay-cycle is created, the relevant payslips are created for each employee with the same pay-cycle type, all weekly employees will be added to a new weekly pay-cycle. You are able to add or delete employees to a pay-cycle using the plus and minus buttons on the table below.

When employees’ pay slips are created the different payroll details are calculated automatically by the system based on the employee payroll details and the pay-cycle type. For example, a weekly base salary will be based on calculating the yearly salary, etc. Other deductions such as superannuation will be calculated based on the employee’s details and in the payroll section of their employee card.

Use the Pay Run button to open the journal and enter the appropriate records for payment of selected pay cycle. Please note that once a payment is made, no changes can be made to a pay cycle or journal. You may use the general journal to enter reconciliation records at a later time.

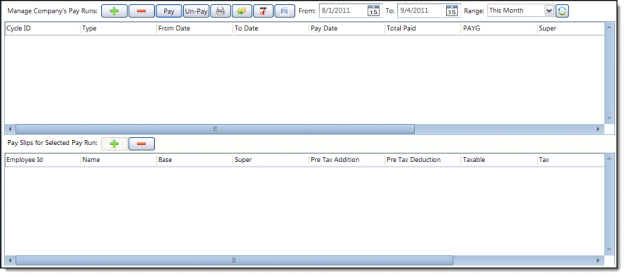

Manage Company’s Pay Run

Use the options in the Manage Company’s Pay Run section to add, delete, pay, print or email payroll entries. Filter the date range for the Pay Runs displayed in the table using the From, To, and Range fields.

The top section of the screen displays Pay Cycle information.

The bottom section of the screen displays Pay Slip information.

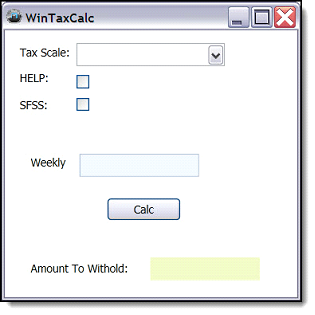

Tax Calculator

The Tax Withholding Calculator is used to calculate TAX withholdings for employees’ wages based on information from the TAX Office, July, 1 2010 (NAT1004).

· Tax Scale

o Select the relevant ATO tax scale for the current employee.

· HELP

o Check the HELP checkbox if it is relevant to this employee.

· SFSS

o Check the SFSS checkbox if it is relevant to this employee.

· SCEP

o Check the SCEP checkbox if it is relevant to this employee.

· Weekly

o The Weekly field displays the amount withheld based on the entered information using the Calc button.

· Calc

o Click the Calc button to calculate the Weekly amount.

Billing

The Billing tab contains features used to deal with billing clients for time worked on their projects or for recording hourly employees’ time. The table below lists the commands available on the Payroll tab and the associated descriptions. Commands are listed by group, from left to right.

|