|

|

Field

|

Description

|

|

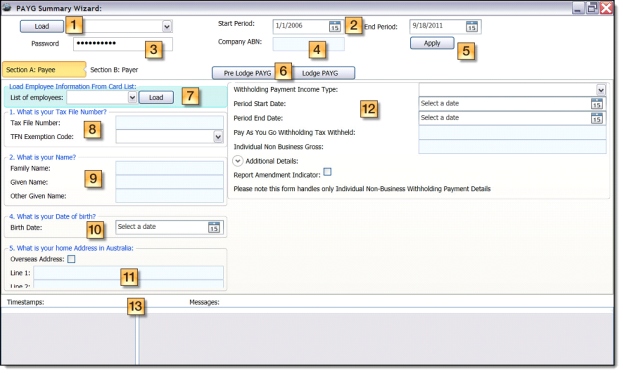

1.

|

Load

TFN List

|

Click the Load button to load an XML file containing your AusKey credentials.

Choose the correct credentials from the TFN List.

|

|

2.

|

Start Period

End Period

|

Select or type the appropriate start date for the period from the Start Period dropdown.

Select or type the appropriate end date for the period from the End Period dropdown.

|

|

3.

|

Password

|

Enter your AusKey password for the BAS.

|

|

4.

|

Company ABN

|

Type the appropriate company ABN in the field.

|

|

5.

|

Apply

|

Click Apply to set your username and verify your password.

|

|

6.

|

Pre Lodge PAYG

|

Click Pre Lodge TFN to submit the Pre Lodge TFND service.

|

|

|

Lodge PAYG

|

Click Lodge TFN to submit the Lodge TFND.

|

|

7.

|

List of Employees

|

Click the List of Employees dropdown to select an employee from the list. This list is created from the card list.

|

|

8.

|

Load

|

Click Load to load the list of employees created from the card list.

|

|

9.

|

What is your tax file number?

|

Type your tax number. Tax numbers are unique numbers issued by the Tax Office to individuals and organisations to identify tax records. It increases efficiencies in administering tax and other Australian Government systems.

If you are unable to report a tax number for an individual, choose the reason from the TFN Exemption dropdown.

|

|

10.

|

What is your Name?

|

Family Name: The payee’s previous surname, where the payee has on the declaration provided a name by which they were previously known to the ATO.

Given Name: The payee’s previous first name, where the payee has on the declaration provided a name by which they were previously known to the ATO.

Other Given Name: The payee’s previous second given name, where the payee has on the declaration provided a name by which they were previously known to the ATO.

|

|

11.

|

What is your Date of birth?

|

Choose the date of birth for the payee.

|

|

12.

|

What is your home Address in Australia?

|

The payee’s home address in Australia. If the payee lives overseas, check the Overseas Address checkbox.

|

|

13.

|

Withholding Payment Income Type

|

Choose the code indicating the type of income being reported in the payment summary.

|

|

|

Period Start Date

|

Choose the appropriate period start date.

|

|

|

Period End Date

|

Choose the appropriate period end date.

|

|

|

Pay As You Go Tax Withholding Tax Withheld

|

Enter any income tax withheld under the Pay As You Go Arrangement.

|

|

|

Individual Non Business Gross

|

Enter any payments of salary, wages, bonuses and commissions paid to the payee as an employee, company director or office holder. Include the total gross amount before amounts are withheld for tax.

|

|

|

Additional Details

|

Click the dropdown to enter any additional details about the payee’s withholdings.

|

|

|

Report Amendment Indicator

|

Check the checkbox if this report contains amended data.

|